JULO Launches Unique Loyalty Program to Enrich Virtual Credit Card Proposition

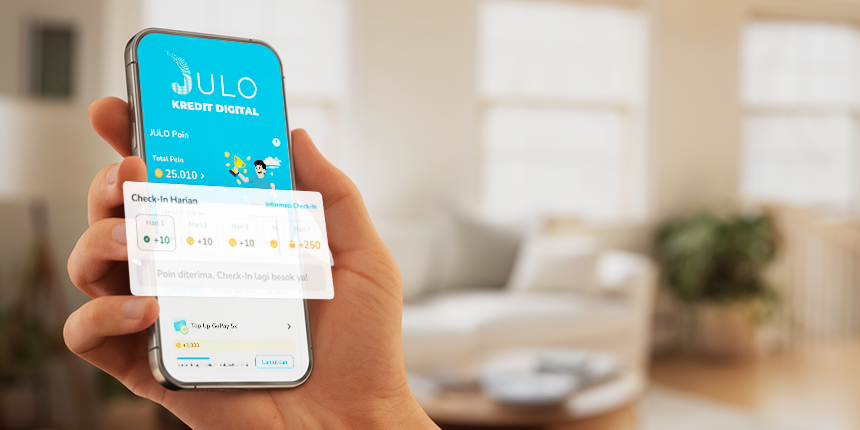

JAKARTA, Nov 5th 2024 – Indonesian financial technology startup JULO continues to push boundaries in financial innovation with the launch of JULO Poin, a rewards program that delivers credit card-like perks to a broader audience through its accessible digital platform. This latest breakthrough aligns with JULO’s mission to democratize credit access in Indonesia, where credit card penetration remains low at just 6%. This initiative also builds on JULO’s unique positioning of a single limit for multiple uses, providing users with flexible, forever-available credit that mirrors the convenience of a credit card.

Beyond enhancing the user experience, JULO Poin is a key driver of loyalty, which is crucial in the financial sector, especially for JULO, where 80% of its portfolio consists of repeat users. With a simple and transparent 1 Poin = 1 Indonesian Rupiah model, JULO Poin turns every transaction into a rewarding experience, making it easy for users to track and maximize their benefits. Staying true to JULO's mission to promote financial literacy, the program also incentivizes responsible credit behavior by rewarding early and timely repayments.

Hitung Pinjaman dan Tagihanmu

Tentukan jumlah dan tenor pinjaman

Rp300.000

Rp50.000.000

*Beberapa nominal pinjaman hanya dapat memilih tenor tertentu

Tagihan per bulan

Dana Cair

Users can redeem points to reduce their installment payments or convert them into e-wallet balances and mobile phone top-ups. This option aligns with the growing preference for e-wallets among Indonesian consumers, with 84% favoring e-wallet payment methods for online purchases, according to the 2023 Indonesian e-Commerce Consumer Behavior Report. With 106.9 million e-wallet users nationwide, JULO Poin caters directly to the needs of today’s digital-savvy consumers with a host of point earn and point burn options.

In the first three months following JULO Poin’s launch in July 2024, around 61% of active users are already actively participating in the program. In September 2024 alone, 100,000 users visited JULO Poin loyalty page, drawn by the program’s hassle-free, single-click redemption feature that makes claiming rewards effortless and appealing.

Nimish Dwivedi, Chief Business Officer of JULO said, “As a financial inclusion provider our aim is to make every click , every swipe and every interaction rewarding and fun to build a long term relationship with our valued customers.”

“JULO Poin is powered by a custom-build system that offers a never-ending range of earn and burn options on a real time basis. The underlying infrastructure ensures a fast process and high levels of security,” added Manoj Awasthi, Chief Technology Officer of JULO.

Read More: JULO Brings Home Three International Awards at the Asia FinTech Awards 2024

This excitement is echoed by JULO user Agus Kristianto, who shared that he prefers JULO Poin over similar rewards programs on other platforms. “It’s so easy to earn points, and it makes transactions more fun. So far, I’ve earned 355,991 points and will definitely do more transactions to get even more rewards.The points are so easy to redeem, and I can win even more rewards on top of the points, like a new gadget, cashback, and other grand prizes.”

JULO Virtual Credit Card currently serves over 2 million users in Indonesia. With a high credit limit of up to USD 3,500, JULO facilitates both cash and non-cash transactions, including e-wallet top-ups, utility payments, e-commerce purchases, as well as education and healthcare expenses. This establishes JULO as a leader in the fintech landscape, offering greater convenience and flexibility compared to other traditional cash loans and Buy Now, Pay Later (BNPL) solutions in Indonesia.

#BisaTerus Cashless with JULO!

Fun fact: There are millions of people getting financially empowered by JULO features!